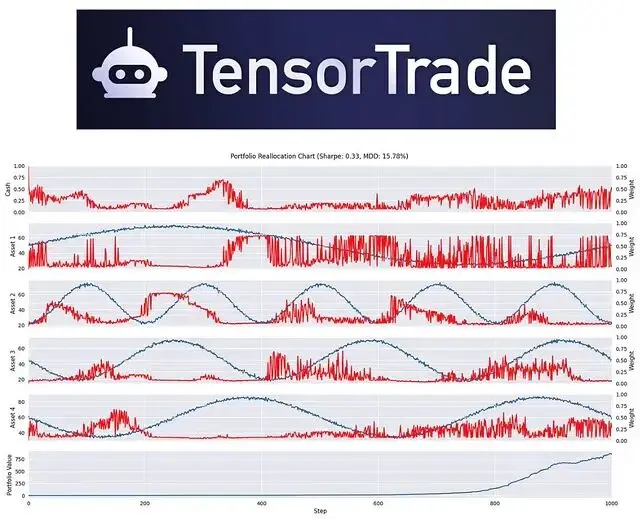

打開交易圖表,堆上十個技術指標,然後對着屏幕發呆不知道下一步怎麼操作——這場景對交易員來説太熟悉了。如果把歷史數據丟給計算機,告訴它“去試錯”。賺了有獎勵,虧了有懲罰。讓它在不斷的嘗試和失敗中學習,最終迭代出一個不説完美、但至少能邏輯自洽的交易策略。

這就是 TensorTrade 的核心邏輯。

TensorTrade 是一個專注於利用 強化學習 (Reinforcement Learning, RL) 構建和訓練交易算法的開源 Python 框架。

數據獲取與特徵工程

這裏用

yfinance抓取數據,配合

pandas_ta計算技術指標。對數收益率 (Log Returns)、RSI 和 MACD 是幾個比較基礎的特徵輸入。

pip install yfinance pandas_ta

import yfinance as yf

import pandas_ta as ta

import pandas as pd

# Pick your ticker

TICKER = "TTRD" # TODO: change this to something real, e.g. "AAPL", "BTC-USD"

TRAIN_START_DATE = "2021-02-09"

TRAIN_END_DATE = "2021-09-30"

EVAL_START_DATE = "2021-10-01"

EVAL_END_DATE = "2021-11-12"

def build_dataset(ticker, start, end, filename):

# 1. Download hourly OHLCV data

df = yf.Ticker(ticker).history(

start=start,

end=end,

interval="60m"

)

# 2. Clean up

df = df.drop(["Dividends", "Stock Splits"], axis=1)

df["Volume"] = df["Volume"].astype(int)

# 3. Add some basic features

df.ta.log_return(append=True, length=16)

df.ta.rsi(append=True, length=14)

df.ta.macd(append=True, fast=12, slow=26)

# 4. Move Datetime from index to column

df = df.reset_index()

# 5. Save

df.to_csv(filename, index=False)

print(f"Saved {filename} with {len(df)} rows")

build_dataset(TICKER, TRAIN_START_DATE, TRAIN_END_DATE, "training.csv")

build_dataset(TICKER, EVAL_START_DATE, EVAL_END_DATE, "evaluation.csv")腳本跑完,目錄下會生成

training.csv和

evaluation.csv。包含了 OHLCV 基礎數據和幾個預處理好的指標。這些就是訓練 RL 模型的數據。

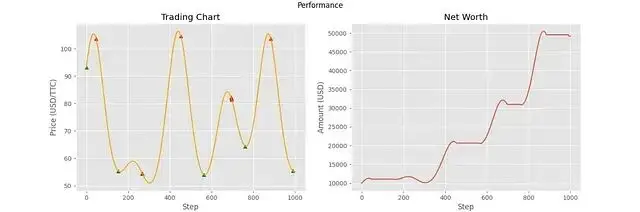

構建 TensorTrade 交互環境

強化學習沒法直接使用CSV 文件。所以需要一個標準的交互 環境 (Environment):能夠輸出當前狀態 (State),接收智能體的動作 (Action),並反饋獎勵 (Reward)。

TensorTrade 把這個過程模塊化了:

Instrument:定義交易標的(如 USD, TTRD)。Wallet:管理資產餘額。Portfolio:錢包組合。Stream/DataFeed:處理特徵數據流。reward_scheme/action_scheme:定義怎麼操作,以及操作的好壞怎麼評分。

pip install tensortrade下面是一個環境工廠函數 (Environment Factory) 的實現,設計得比較輕量,這樣可以方便後續接入 Ray:

import os

import pandas as pd

from tensortrade.feed.core import DataFeed, Stream

from tensortrade.oms.instruments import Instrument

from tensortrade.oms.exchanges import Exchange, ExchangeOptions

from tensortrade.oms.services.execution.simulated import execute_order

from tensortrade.oms.wallets import Wallet, Portfolio

import tensortrade.env.default as default

def create_env(config):

"""

Build a TensorTrade environment from a CSV.

config needs:

- csv_filename

- window_size

- reward_window_size

- max_allowed_loss

"""

# 1. Read the dataset

dataset = (

pd.read_csv(config["csv_filename"], parse_dates=["Datetime"])

.fillna(method="backfill")

.fillna(method="ffill")

)

# 2. Price stream (we'll trade on Close)

commission = 0.0035 # 0.35%, tweak this to your broker

price = Stream.source(

list(dataset["Close"]), dtype="float"

).rename("USD-TTRD")

options = ExchangeOptions(commission=commission)

exchange = Exchange("TTSE", service=execute_order, options=options)(price)

# 3. Instruments and wallets

USD = Instrument("USD", 2, "US Dollar")

TTRD = Instrument("TTRD", 2, "TensorTrade Corp") # just a label

cash_wallet = Wallet(exchange, 1000 * USD) # start with $1000

asset_wallet = Wallet(exchange, 0 * TTRD) # start with zero TTRD

portfolio = Portfolio(USD, [cash_wallet, asset_wallet])

# 4. Renderer feed (optional, useful for plotting later)

renderer_feed = DataFeed([

Stream.source(list(dataset["Datetime"])).rename("date"),

Stream.source(list(dataset["Open"]), dtype="float").rename("open"),

Stream.source(list(dataset["High"]), dtype="float").rename("high"),

Stream.source(list(dataset["Low"]), dtype="float").rename("low"),

Stream.source(list(dataset["Close"]), dtype="float").rename("close"),

Stream.source(list(dataset["Volume"]), dtype="float").rename("volume"),

])

renderer_feed.compile()

# 5. Feature feed for the RL agent

features = []

# Skip Datetime (first column) and stream everything else

for col in dataset.columns[1:]:

s = Stream.source(list(dataset[col]), dtype="float").rename(col)

features.append(s)

feed = DataFeed(features)

feed.compile()

# 6. Reward and action scheme

reward_scheme = default.rewards.SimpleProfit(

window_size=config["reward_window_size"]

)

action_scheme = default.actions.BSH(

cash=cash_wallet,

asset=asset_wallet

)

# 7. Put everything together in an environment

env = default.create(

portfolio=portfolio,

action_scheme=action_scheme,

reward_scheme=reward_scheme,

feed=feed,

renderer=[],

renderer_feed=renderer_feed,

window_size=config["window_size"],

max_allowed_loss=config["max_allowed_loss"]

)

return env這樣“遊戲”規則就已經定好了:觀察最近 N 根 K 線和指標(State),決定買賣持(Action),目標是讓一段時間內的利潤最大化(Reward)。

基於 Ray RLlib 與 PPO 算法的模型訓練

底層環境搭好,接下來讓 Ray RLlib 介入處理 RL 的核心邏輯。

選用 PPO (Proximal Policy Optimization) 算法,這在連續控制和離散動作空間都有不錯的表現。為了找到更優解,順手做一個簡單的超參數網格搜索:網絡架構、學習率、Minibatch 大小,都跑一遍試試。

pip install "ray[rllib]"訓練腳本如下:

import os

import ray

from ray import tune

from ray.tune.registry import register_env

from your_module import create_env # wherever you defined create_env

# Some hyperparameter grids to try

FC_SIZE = tune.grid_search([

[256, 256],

[1024],

[128, 64, 32],

])

LEARNING_RATE = tune.grid_search([

0.001,

0.0005,

0.00001,

])

MINIBATCH_SIZE = tune.grid_search([

5,

10,

20,

])

cwd = os.getcwd()

# Register our custom environment with RLlib

register_env("MyTrainingEnv", lambda cfg: create_env(cfg))

env_config_training = {

"window_size": 14,

"reward_window_size": 7,

"max_allowed_loss": 0.10, # cut episodes early if loss > 10%

"csv_filename": os.path.join(cwd, "training.csv"),

}

env_config_evaluation = {

"max_allowed_loss": 1.00,

"csv_filename": os.path.join(cwd, "evaluation.csv"),

}

ray.init(ignore_reinit_error=True)

analysis = tune.run(

run_or_experiment="PPO",

name="MyExperiment1",

metric="episode_reward_mean",

mode="max",

stop={

"training_iteration": 5, # small for demo, increase in real runs

},

config={

"env": "MyTrainingEnv",

"env_config": env_config_training,

"log_level": "WARNING",

"framework": "torch", # or "tf"

"ignore_worker_failures": True,

"num_workers": 1,

"num_envs_per_worker": 1,

"num_gpus": 0,

"clip_rewards": True,

"lr": LEARNING_RATE,

"gamma": 0.50, # discount factor

"observation_filter": "MeanStdFilter",

"model": {

"fcnet_hiddens": FC_SIZE,

},

"sgd_minibatch_size": MINIBATCH_SIZE,

"evaluation_interval": 1,

"evaluation_config": {

"env_config": env_config_evaluation,

"explore": False, # no exploration during evaluation

},

},

num_samples=1,

keep_checkpoints_num=10,

checkpoint_freq=1,

)這段代碼本質上是在運行一場“交易機器人錦標賽”。Ray 會根據定義的參數組合並行訓練多個 PPO 智能體,追蹤它們的平均回合獎勵,並保存下表現最好的 Checkpoint 供後續調用。

自定義獎勵機制 (PBR)

默認的

SimpleProfit獎勵邏輯很簡單,但實戰中往往過於粗糙。我們有時需要根據具體的交易邏輯來重塑獎勵函數。比如説基於持倉的獎勵方案 PBR (Position-Based Reward):

- 維護當前持倉狀態(多頭或空頭)。

- 監控價格變動。

- 獎勵計算 = 價格變動 × 持倉方向。

價格漲了你做多,給正反饋;價格跌了你做空,也給正反饋。反之則是懲罰。

from tensortrade.env.default.rewards import RewardScheme

from tensortrade.feed.core import DataFeed, Stream

class PBR(RewardScheme):

"""

Position-Based Reward (PBR)

Rewards the agent based on price changes and its current position.

"""

registered_name = "pbr"

def __init__(self, price: Stream):

super().__init__()

self.position = -1 # start flat/short

# Price differences

r = Stream.sensor(price, lambda p: p.value, dtype="float").diff()

# Position stream

position = Stream.sensor(self, lambda rs: rs.position, dtype="float")

# Reward = price_change * position

reward = (r * position).fillna(0).rename("reward")

self.feed = DataFeed([reward])

self.feed.compile()

def on_action(self, action: int):

# Simple mapping: action 0 = long, everything else = short

self.position = 1 if action == 0 else -1

def get_reward(self, portfolio):

return self.feed.next()["reward"]

def reset(self):

self.position = -1

self.feed.reset()接入也很簡單,在

create_env函數裏替換掉原來的

reward_scheme即可:

reward_scheme = PBR(price)這樣改的好處是反饋更密集。智能體不需要等到最後平倉才知道賺沒賺,每一個 step 都能收到關於“是否站對了隊”的信號。

後續優化方向與建議

這套流程跑通只是個開始,想要真正可用,還有很多工作要做 比如:

- 數據置換:代碼裏的

TTRD只是個佔位符,換成真實的標的(股票、Crypto、指數)。 - 特徵工程:RSI 和 MACD 只是拋磚引玉,試試 ATR、布林帶,或者引入更長時間週期的特徵。

- 參數調優:

gamma(折扣因子)、window_size(觀測窗口)對策略風格影響巨大,值得花時間去掃參。 - 基準測試:這一步最關鍵。把你訓練出來的 RL 策略和 Buy & Hold(買入持有)比一比,甚至和隨機策略比一比。如果跑不過隨機策略,那就得從頭檢查了。

最後別忘了,我們只是研究,所以不要直接實盤。模型在訓練集上大殺四方是常態,能通過樣本外測試和模擬盤 (Paper Trading) 的考驗才是真本事。

https://avoid.overfit.cn/post/8c9e08414e514c73ab3aefd694294f79

作者:CodeBun